|

|

Post by jonnygemini on Nov 30, 2005 12:03:30 GMT -5

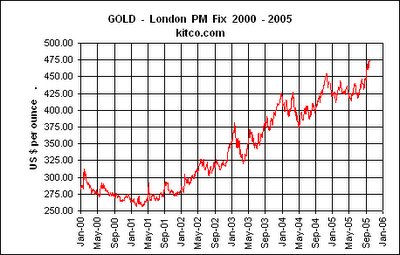

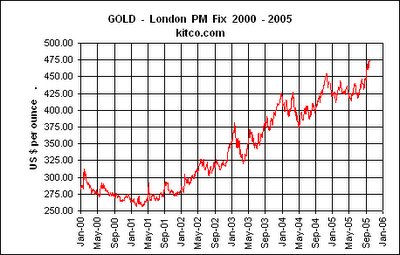

Univ7 our boy Kentroversy has a new blog...pure fire: kentroversypapers.blogspot.com/How high will the price of GOLD rise before you consider buying some? Earlier today, GOLD crossed the $500 per ounce barrier, for the first time since 1987! What is fueling this rise in the value of GOLD, SILVER, and all other precious metals, is the massive imminent collapse of the United States economic system. I started telling all my friends and family that they need to start buying GOLD about eight years ago. What I saw, was a nation's economy on the brink of collapse --- with no hope of saving the USA from catastrophic disaster. The nation's debt is now $8 TRILLION DOLLARS . . . The net savings of the nation's citizens is now BELOW ZERO --- and this is because their debts are exceeding their savings . . . Both GENERAL MOTORS and FORD MOTOR COMPANY are now both bankrupt --- which threatens the MACHINE-TOOL MANUFACTURING capabilities of this country . . . The stock market is once again fattened from the PUMP AND DUMP ethics of brokerage houses that are once again fleecing people of their life savings --- those who are stupid enough to fall for this YET AGAIN . . . The CRIMINAL SYNDICATE known as the FEDERAL RESERVE recently announced that they are no longer posting public information regarding the nation's M3 money supply. This has been done to hide the fraud and the manipulations that will have to be increasingly deployed in an attempt to keep this whole system from collapsing. They are h oping to push this off into the future as far as possible . . . The housing market, the stock market, and the money supply have been manipulated in an effort to provide the illusion that everything is okay --- and it is business as usual. Major global corporations are now being caught for LYING about the true financial condition of their company and business . . . Major mass media news outlets are lying about their readership and viewership. For instance, the circulation of my hometown newspaper THE BUFFALO NEWS is so low that the management has adopted the tactic of giving out FREE NEWSPAPERS on every major holiday. After asking my deliveryperson to PLEASE STOP leaving me these free papers, I finally had to cancel the paper entirely, even though my wife wanted it for the food coupons from the Sunday morning paper. TV ratings are down --- especially the NEWS --- which is more propaganda and conditioning of the viewer's mind --- than it is actual NEWS. Those who listened to me eight years ago, have now more than doubled their money. Those who listened understand that GOLD will eventually reach $1,500 or more per ounce before this country is totally destroyed from within. Those who DID NOT listen and stayed with their stocks, have lost everything they had in the market --- and are now too embarrased to talk to me or anyone else about the loss of their life's savings. Those who told me that GOLD at $500 per ounce was a conspiracy theory have laughed at my advice, which lost them everything. Those who listened are already set to have an excellent chance of surviving the HARD TIMES that lie ahead. Next up for GOLD --- $800 per ounce . . . Will YOU buy some, or continue hoping that your GOOGLE stock stays north of $500 per share? WHO will have the LAST LAUGH? He who holds the GOLD . . . NOTE: Here below is a historical chart showing the growth of the price of gold in the last five-plus years . . .  |

|

|

|

Post by jonnygemini on Nov 30, 2005 13:28:52 GMT -5

Former Fed Res employee

User ID: 14350

11/30/2005

1:16 pm EST 1 out of every 4 US dollar notes is a perfect forgery, and the federal government would rather that you remain ignorant of this fact

I like your forum.

My name is .... well, I think we should skip formalities. This secret has already killed some very observant and well-informed people who weren´t "important" enough to merit a free pass.

Anonymous Coward

User ID: 14283

11/30/2005

1:25 pm EST Re: 1 out of every 4 US dollar notes is a perfect forgery, and the federal government would rather that you remain ignorant of this fact

If the notes are PERFECT forgeries, how can even the Fed spot them? There has to be a difference or one couldn´t say that 1 out of 4 notes is bogus.

.

FFRE

User ID: 14350

11/30/2005

1:28 pm EST Re: 1 out of every 4 US dollar notes is a perfect forgery, and the federal government would rather that you remain ignorant of this fact

The Federal Reserve has no interest in correcting this matter. They are part of the problem.

|

|

|

|

Post by UniverseSeven on Nov 30, 2005 15:19:11 GMT -5

Peace 8 JG thanks for bringing his blog to my attention. I had been recently thinking of this fellow and the original article I posted by him. There is fresh talk in the market about GM's impending bankruptcy, it is no coincidence that gold is nearing 500, nor that oil has slid down to 56.00 a barrel for the holidays, GO CONSUME! At this point I feel it is important that people start preparing and planning for what is ahead. Gold will hit 800.00+ an oz. Me, I am leaving the States for starters. I would advise the same to anybody who is in the know. I don't think the frog will be cooked till 2008, at that point things will be painfully obvious to anyone who does not support what is happening. By that time it will too late for most. Gnawing their tounges comes to mind. I don't care about leaving family behind, or the bells and whistles. I've been off the soma since 1990. What do you do when your house is collapsing or catching fire? You make for the nearest exit! Shouldn't have been in a house with cracked foundations in the first place, Unless your going to repair them (or put the fire out). If only our parents and grandparents could see Her for what she really is and not get addicted to the wine and the sorcery.

Selling souls for trinkets.Is that smoke I smell?Come if you like, but you staying, won't stop me from going.....that's how I look at it. God above all else. I had to talk my Mother out of getting a flu vaccine today! The propaganda of fear is effective... This is not propaganda.

The Truth is hard to hear.Tick, Tock goes the clock. P+E(AC)=E www.biblegateway.com/passage/?search=Genesis%2018-19&version=31; |

|

|

|

Post by jonnygemini on Dec 7, 2005 11:53:32 GMT -5

The Future is a Free-For-All

For years now I've had an active interest in watching the actions of "the powers that be", to use a phrase which is probably as fitting as any. Perhaps this fetish is the result of a kind of misplaced jealousy, but I personally prefer to believe that I'm only upholding the Jeffersonian ideal that cautions us to keep a critical and ever-watchful eye on our society's commanders.

And still another impulse stems from my experience in the financial markets. Anyone who's spent years in trading acquires a rather obtuse way of viewing the world. Because in the financial markets you cannot profit by waiting for "facts" and "proof". That's because for every potential opportunity there will always be "insiders" who know far more than you ever could have, and know it before you ever could have. Those insiders will be loading up their positions, putting their plans into place so to speak. However, with a trained eye you can learn to read their actions in the movements of the market. Their actions will tell you what they know. Then gradually the trend picks up steam and momentum as all the "trained eyes" out there begin to jump on board, then further momentum as the movement begins to generate it's own interest....in fact the build-up generally continues right up until the "news" actually hits the printed page and the facts are plain for all to see. And in certain cases it seems the insiders are the ones releasing this news. But regardess, more times than not that's precisely the point at which the insiders will begin to cash-out -- they'll unwind their positions and realize the fruition of all of their plans. And they'll do it right into the eager faces of the so-called "dumb money"--the patient, responsible people who perenially wait to take action until the facts are on the table, clear for all to see.

So with all this as background I was particularly struck by a couple articles posted last Friday over at Matt Savinar's site Life After the Oil Crash (which has been posting a wealth of information over the past couple months). The first was this transcript of a 1982 report entitled: "THE GLOBAL 2000 REPORT TO THE PRESIDENT: Entering the Twenty-First Century: A report prepared by the Council on Environmental Quality and the Department of State." The essential take-away "bite" was the following tidbit:

"This chapter presents U.S. and world energy forecasts for the midrange (1985-90) and the long range (to the year 2000). The forecasts, made during the spring of 1978, endeavor to reflect a range of uncertainty in future economic and demographic growth by presenting three projections of energy consumption trends." [...] "The conclusions can be summarized as follows:

...Petroleum production capability is not increasing as fast as demand....In the long term, the rate of petroleum reserve additions appears to be falling. As a result, engineering considerations indicate that world petroleum production will peak in the 1990-2010 interval at 80-105 million barrels per day, with ultimate resources estimated at 2,100 billion barrels."

Now I don't want to engage in any peak oil discussion, perhaps this report is right or perhaps it's wrong. But the thing I felt was worth highlighting was exactly what Matt points out: this just adds further confirmation that oil-depletion is not a new or fringe idea up on Capitol Hill, nor for that matter in any of the halls of corporate or government leadership. On the contrary, it's really only the general population of the country that is just beginning to catch on....having to catch on for themselves, since this information was never substantially presented to them.

But let's put that thought on hold, because the next little morsel of brain-food comes via this weeks Falls Church News-Press (which as I've mentioned before is perhaps the most influential "local" paper in the world). As peak-oilers probably already know, they've been covering the issue in serial fashion for several months now. Well here's just a snippet from the latest piece (which is nonetheless deserving of a full read):

"Until recently, the phrase “peak oil” was among the last elected and appointed official in Washington wanted to hear or see in print. Should there be any doubt as to the correctness of their position, one only has to look at what happened when President Carter donned a cardigan sweater and told us how one day we were going to run short on oil and how we should start sacrificing now to prepare for it.

Relevant administration officials are well aware world oil production will peak someday, but for obvious reasons, they don’t want to acknowledge this until they absolutely have to. They hope beyond hope peaking won’t happen until after they retire so somebody else can deal with the unpleasant consequences. "

I've said it in the past, and a great many others concur, it's always been foolish to believe that oil depletion was somehow an "unknown" or even an "uncertain" in Washington, D.C. As the News-Press puts it the "relevant administration officials" (a phrase to take special note of) have certainly known about the situation for years. Perhaps they don't know the actual "peak" date with any certainty, but they undoubtedly have a pretty good general feel for it. And I think it's safe to assume that if that peak period is indeed quite near (or even passed), that they have been preparing for that for some time as well. I think it's very important that we acknowledge this directly. Because when we know this to be the case, then we have to also recognize two inarguable facts.

The first is that we are on our own, that there is clearly no substantial intention to "deal" with the situation in any way whatsoever -- or perhaps more specifically, whatever preparations our elites have put into place, they did not involve us in them (I'm not thinking along "sinister" lines here but just considering evidence such as Bush's "state of the art" sustainable home, and David Rockefeller's and Sun Myung Moon's alleged multi-million dollar "intentional communities", etc.). Now admittedly in these past few "post-Katrina" months, this abdication by our government of its most basic social responsibilities has become broadly apparent. But to consider it in relation to a pending peak oil crisis allows us to seriously question, for instance, why we presently have an administration that is almost offensively preoccupied with pursuing its own personal interests and agenda to the exclusion of even its most nominal "administrative" duties. In other words -- and I know I'm not saying anything all that earth-shattering here -- I suggest the reason our government's actions have become so divorced from the "will of the people" is not because they are simply power-hungry and unconscionable sociopaths, but because they are blindly pursuing their own version of "A Blueprint for Preparation"...their own agenda of preparation for a global fossil-fuel depletion crisis.

The second thing we need to face is actually just a corollary of the first: our future is a free-for-all. We may very well be in the bottom of the 9th, in which case the team that's leading also has the last at-bat. So if it seems as if they're playing like they've already won the game, then it's likely because they have. And if they act like there will be no censures or repercussions for their actions, then it's likely because they truly believe that there won't be (and if there are, they're apparently content to just hang them all on "velcro" Cheney, who apparently has long felt that his "second job" in the White House takes up too much of his time...). Realistically, thought, doesn't this explain the humiliating flagrance of all their offenses? Can there really be any doubt that the present administration has literally bet the bank toward achieving their vision of hegemony? Does their every action not give the impression that they believe the game itself doesn't even matter anymore? People who have much to lose are usually the most conservative in their risk-taking; so I would suspect the boldness of this administration's actions on the world stage may not so much indicate that they've felt they were "untouchable", as many people have argued, but perhaps instead that they strongly feared they stood to lose a great deal regardless, and therefore felt driven to undertake desperate measures of self-preservation. And I probably shouldn't have to point out that most of the current U.S. administration consists of energy industry insiders.

Now I don't wish to necessarily imply that anything nefarious is underway, that 9/11 was a set-up or that the "war on terror" is not a war to be fought so much as one to be incited.... Perhaps these things are true, but then again perhaps not. And admittedly I also can't really speculate too far into the lives of people in power, since they live in a different world than I do. But undoubtedly even that world consists of further social sub-levels and sub-groupings. So personally I imagine the simplest scenario: that we probably have just a handful of concerted survivalists in power who have leveraged their "insider" awareness of our pending crisis into an all-or-nothing grab for the brass ring--which is apparently becoming "Kings of the Earth" (and actually, I suspect they've royally bumbled it, but that's neither here nor there). But still, this is likely just a renegade bunch, a especially closed-minded clique within the larger social-circle of the elite. The rest of the likely "insiders" to this issue are probably just quietly going about their business, perhaps arranging their personal lives however they might and not making too many more waves in the mainstream of society than they are already accustomed to do. After all, the coming period of crisis is going to be a truly unique situation for all of us. The "world of the elites", if we might call it that, will realistically only reflect in microcosm what we already see on any popular peak oil discussion board, for instance. Some of these individuals will fear for the worst, and tend toward preparing themselves to maintain their sovereignty and control amidst a society that they feel certain will descend to those worst levels of beastiality that they undoubtedly recognize in themselves. But others within the "elite" will probably simply hope against hope for the best, and continue to run their businesses and lives the same way they always have, painting "crisis" talk as perhaps legitimate but really not worth getting oneself all that worked up over--"life's too short", as they say.... And some will undoubtedly bury their head in the sand, ignoring the evidence altogether. And perhaps even a certain subset will try to align themselves toward meeting an uncertain future with an open-mind and a flexible attitude -- although they certainly won't try to "warn" the general populace ahead of time because that would only cause panic and precipitate the situation (or more likely just fall on deaf ears and cause them to appear foolish). Maybe they won't even struggle to cling to all they've achieved...who knows? It takes all kinds to make a world.

So to finalize the above jumble of thoughts, I'd say that for my money I don't think we should or even need to wait until we see the evidence for peak oil on the cover of the NY Times. The circumstantial evidence is abundant already, for those who don't believe the outright admissions like the articles above. And besides, the things we need to be doing to prepare for a decline in fossil-fuel supplies are simply the things we should be doing as responsible human being anyway...the things we should have started doing way back when Jimmy Carter told us to: we need to be reigning in our consumption to buy ourselves more time. We should begin integrating with a more self-reliant way of living, maybe even detaching ourselves ahead of time from our automobile- and industrial agriculture-dependent lifestyle. We need to stop supporting the corporations who extort the Earth's resources and our human

But the one thing we should not be doing is just sitting on our hands. Because if the future is a free-for-all, then that means there is great opportunity to be seized as all the old rules, the ingrained habits, the institutionalized systems and the hard-fought hierarchies get shaken up and "redistributed" a little bit, and the playing field is levelled. I'm not saying this will happen completely or that it will happen overnight, but when our system collapses there will be as much creative energy released as there is destructive. It will be a time for gaining new things even as we're being stripped of the old, a time for us to experience expansive new freedom as well as a desperate clinging for control. It will be a time of soul-searching and of blame-casting, of unanswered questions and unquestioned answers. But when all is said and done, we will no doubt look back on the events that are still to come with a bittersweet fondness, the way we do all our growing pains. Thankful that they're over, but even more thankful that we had them.

|

|

|

|

Post by jonnygemini on Dec 9, 2005 13:57:18 GMT -5

A Crisis of Confidence via: deconsumption.typepad.com/deconsumption/Gold is on an unbelievable tear lately, blowing right through $500/oz and surging higher every day. And while I don't much talk about day-to-day market news, I think this is an incredibly significant event, and therefore one to take note of. For one thing it means gold has likely broken free of the chains the monetary-control stormtroopers have had it in for more than a decade. Now there's a whole host of reasons why it's in the interest of certain federal authorities to keep gold on a tight rein, but suffice it to say they all boil down to one thing: confidence. Authority is built on a foundation of popular confidence, and the major flagpost of that confidence is monetary strength (ie. strength in the dollar--or at least 'perceived' strength since in the larger scope controlled weakness is actually the integral purpose of the system...). So it seems appropriate now to paint this picture in the proper light. In the financial markets there are two ends to every stick as far as price movement is concerned, and such is especially the case with the price of gold. The common-man's viewpoint (which is also the view of the mass media) is simply that the "price" of gold is going up, but this incorrectly implies that the value of the dollar (or any other currency against which it's being measured) is holding stable and that it's only gold itself that is in rising demand. But in the price of any security or commodity, both the thing itself and the underlying currency in question are in flux, as neither one is of stable value. Therefore the price only reflects their value at a particular point relative to each other. This is why it can be observed that in a high inflation environment -- and all things being equal -- the Dow Jones Industrial Average will naturally tend to rise, but that it's a false assumption to believe that it's actually increasing in value. It's simply 'adjusting' itself to the declining value of the dollar. However our particular case is special in that gold is generally held to be the most stable reference of value we know (when it's not being manipulated), for a host of practical reasons we probably don't need to go into. So the other end of the stick, which is actually the more valid point of view, holds that gold is the reference point by which the value of the dollar is being judged. So long story short, I think there are a couple of scenarios: either gold has finally broken free of the gold-police and is racing to discover its real value in relation to the dollar and other currencies, or else we're witnessing a decisive plunge in currency confidence -- not just the US dollar but paper currencies in general, since investors are not simply fleeing one currency in favor of another but are effectively fleeing currencies altogether for real asset value (which, by the way, might suggest a possible connection with the recent decline in the real estate market -- the most recent wildly-popular avenue of "real asset value"...). Of course fans of paper-money (you know, the Gub-mint) could argue that neither case is true, that this is simply an isolated surge in the demand for gold, an investment trend or secular commodity trend or such. But I'd protest that a move of this strength occuring in combination with strong movements in other precious metals, and in further conjunction with widespread social, political and economic crises, that what we're actually seeing is a combination of both these scenarios. In other words, a general crisis of confidence and flight to quality which has overwhelmed the Fed's ability to control the market any longer. For those who are interested (and who don't regularly follow the deconsumption news room) I'll reference this November Barron's interview www.siliconinvestor.com/readmsg.aspx?msgid=21901712 with Toqueville Gold Fund manager John Hathaway back in November, where he very effectively makes a case, as I interpret it, that gold is destined to rise simply because investors are fast running out of other options. And that my friends is a crisis of confidence, in a nutshell. Also I think it's also important to note that in my experience market moves like this almost invariably anticipate a more general awareness in the social sphere....so I would expect to see this important tipping-point echoed in a myriad other ways over the next few months. And I might further add that there are many gold market analysts who have long held that a strong surge in gold would likely place some of those aforementioned monetary-control-freaks in a very disconcerting short-covering situation. |

|

|

|

Post by jonnygemini on Dec 13, 2005 11:21:39 GMT -5

So why is gold going up?? Central Banks Now Buying Gold Silver Stock Report www.silverstockreport.comDecember 10, 2005 Jason Hommel The Russian Central bank is buying up to 1,000 tonnes of gold to double its gold holdings from 500 tonnes, most of which, 377 tonnes, is lent out.

The news of Russian Central Bank gold buying is getting more press. Either the Russian buying, or the news of the Russians buying is likely responsible for the recent run up in gold prices.

Analysis: The Russians have $165 billion in their central bank reserves. 500 tonnes x 32,152 oz/tonne = 16,076,000 oz. That's 16 million oz. At $524/oz., 500 tonnes will be worth $8,423,824,000 That's $8.4 billion dollars.

That's not much money, and it's a lot of gold!

The Russians are only planning on putting 5% of their Central Bank reserves into gold.

Why is this such a big deal? The world has lots of dollars and not much gold.

Five hundred tonnes is huge in the gold world. World mine supply is a mere 2,500 tonnes annually. Total gold mined in all of human history is a mere 150,000 tonnes. Source: gold.org

To put 16 million ounces of gold into context as to how much that is, Barrick, the second largest gold mining company in the world hedged (ie presold, about 13 million oz. of gold at prices around $330/oz). At $524/oz., that's a loss of about $2.5 billion dollars. Barrick could go bankrupt from this "gold debt". If you own Barrick, or any of the other hedged gold miners such as Placer Dome, I strongly recommend that you sell them, and buy unhedged stocks, or exploration companies, or physical metal, instead. Barrick can no longer afford to buy 13 million oz. of gold to settle this gold debt, because it would take more cash than Barrick has.

However, buying 16 million oz. of gold will be no problem for the Russians. They have $165 billion dollars to diversify out of.

Let me continue to put 500 tonnes (16 mil. oz.) into perspective:

European Central Banks agreed to limit their gold selling to 400 tonnes per year in 1999. Due to the announcement back in the fall of 1999, it caused a $70 spike upwards in the gold price, and you can see this spike on any gold chart. Why the spike? Because people realized that the gold selling (and gold lending) by Central Banks was going to be slowing down. And it has.

And now it has reversed...indeed turning into Central Bank gold buying.

Argentina, South Korea and South Africa are also gold buyers now.

And now, China and perhaps all of Asia!

Here's a news article about it:

Asian Central Banks likely to increase gold reserves!

The official China news source, the "People's Daily Online", reported that "Asian Central Banks are likely to increase gold reserves."

Quote: "Russia, Argentina and South Africa have decided this month to increase their gold reserves, which reversed the selling trend of six years by world Central Banks, especially European ones. It is only a question of time for Asian Central Banks to follow and buy gold: they hold 2.6 trillion US dollars in foreign exchange reserves, and able to change more of them into gold as a hedge against US dollar falls."

So, how much gold can $2.6 trillion U.S. dollars, held by Asian Central Banks, buy? More gold than exists in the world! Remember, all the gold ever mined in the history of the world is 150,000 tonnes.

Let's convert that to ounces, shall we?

All the gold ever mined in the history of the world:

150,000 tonnes x 32,152oz./tonne = 4.8 billion ounces.

At current prices of $524/oz., that's 2.5 trillion dollars !!!!!!

So, what we have is the Russians buying about $8.4 billion worth of gold, and this is causing the gold price to move up.

And now, Asia is going to spend a portion of $2.6 trillion, that's TRILLION, or $2,600 billion, on gold?

Where do you think gold prices are headed? At this point, guessing a final top is ridiculous, but you can know for certain that in the coming months and years, gold is going to go way, way, way up from here. Probably well beyond $10,000 to $30,000/oz.

And Asia's $2.6 trillion is nothing compared to the size of the bond markets. We have $22 trillion in U.S. bonds that could also be sold for gold. After all, big money is FORCED to seek real returns, and protect itself from being devalued.

And Japan alone has about $10 trillion dollars worth of yen in savings that could also buy gold.

(Editor's Note: FOREX market trades about $2.5 trillion daily in foreign currencies)

What will spook the bond market? Who knows, but it may well be the default of General Motors on almost $300 billion in GM bonds.

I saw Kudlow on CNBC this afternoon, who was mystified by the rise in the gold price. He asked a woman on the show, "Would you be selling gold now?" She responded, "Yes, I would be selling gold now... but I don't have any gold to sell." Classic!

Kudlow concluded that with the new computer age, and with free trade, both pushing down wages and consumer prices, that he couldn't see inflation like we had under Jimmy Carter. What Kudlow fails to realize is that inflation is not raising wages and consumer prices. Inflation is the creation of unbacked paper money, which has happened in the past -- and that fraud will soon be discovered.

Kudlow also said: "how could the bond market be wrong", given low interest rates, especially in the long bonds, which is now an "inverted yield curve?" What Kudlow fails to realize is that acorns can grow into big oak trees, but oak trees cannot grow to the moon. There is an upper limit on growth, especially in big, big things, such as the $22 trillion bond market. It has to go down in value, by definition, if you study compound growth rates. You just can't keep compounding liquid wealth (that competes with gold) that has overgrown the limits of gold, even if you pretend that gold does not exist. Because other people may not choose to live in fantasy land, and because gold does exist, and because other people (that you may do business with) will choose gold, such as all of Asia.

The fact is bonds and gold are competing asset classes. With gold's value increasing about 20% per year since 2001 (from $255/oz with no top in sight), why would any logical person choose to hold bonds paying a mere 4%, when inflation is about 7-8%? With bonds guaranteed to go down in value, smart money will be forced to buy gold for real returns. It's as simple as that !

Bonds lose money in two ways: Bonds ARE NOW losing value, as the interest rate remains low, since the interest rate is below the rate of inflation. As interest rates MUST RISE, bond values will inevitably lose face value.

Now, please don't misunderstand me. Don't go out and buy gold tomorrow based on what I've written, unless you have well over a billion dollars to invest. If you have less than that, you'd probably do better to buy silver, instead, due to the feared silver shortage caused by 60 years of industrial consumption. A billionaire would have trouble buying that much silver. As gold rises, silver stands to go up much faster and at a greater percentage rate. |

|

|

|

Post by jonnygemini on Dec 16, 2005 9:03:29 GMT -5

As gold rallies, a fringe claims victory Major gold bug says conspiracy beaten By GORDON PITTS Friday, December 16, 2005 Posted at 4:23 AM EST From Friday's Globe and Mail Bill Murphy believes the forces of darkness are finally on the run. The U.S. gold bug is claiming victory over the central bankers, the political heavies and the conspiracy of silence that has kept his message of gold market manipulation out of the U.S. media. "We're characterized as these helicopter loonies -- and that's crazy," says Mr. Murphy, 59, shouting into the telephone yesterday as he prepared to board a plane. The source of his exaltation is gold at more than $500 (U.S.) an ounce, and, despite recent softness, being up 17 per cent this year. In the view of Mr. Murphy and his followers, this is powerful evidence that the "gold cartel," which has denied the yellow stuff its rightful place as a reserve currency, has lost control of its once-rigged market. It means gold should top $1,000 within two years on its way to between $3,000 and $5,000, the Dallas-based Mr. Murphy proclaimed. The propagation of conspiracy theories around the manipulation of precious metals has a long and rather dubious history. But over the past decade, Mr. Murphy, a former pro football receiver and Wall Street futures trader, has lent an intellectual patina to the cause by assembling a loyal core of consultants and academics around his Gold Anti-Trust Action Committee, or GATA. Mr. Murphy argues the current gold surge began with a GATA meeting of about 100 true believers in the summer in, appropriately enough, Dawson City, centre of the 1898 Klondike gold rush. The Dawson City meeting was attended by a key Russian official, lending credibility to the cause, he said. Russia, along with China and Saudi Arabia, have led the upsurge in demand for gold that has overwhelmed the U.S.-based cartel, he observed. At the heart of his worldview is that the U.S. Federal Reserve Board for years leased out large amounts of gold in paper certificates to suppress the price, thus bolstering the U.S. dollar as a reserve currency. The masterminds were Alan Greenspan, outgoing Fed chairman, and major U.S. financial institutions, GATA alleged. The theory is that the U.S. Gold Reserve in Fort Knox does not have enough bullion on hand to meet its paper obligations. With the price rising and supply squeezed, the need to cover short positions with real gold will create a giant price increase -- and a potential crisis. Evidence that the tide is turning, Mr. Murphy said, can be seen in the relative strength of the U.S. dollar against major currencies, at the same time gold is climbing. Hence, proof that gold and the greenback are not joined at the hip, Mr. Murphy said. GATA has some high-powered allies, including Eric Sprott, the Toronto investment manager, and his precious metals guru John Embry, both of whom attended the Dawson City meeting, Mr. Murphy said. In his commentaries, Mr. Sprott has lent credibility to Mr. Murphy's views by citing them as possible theories behind market moves. Mr. Murphy is "a tenacious, very tough guy," said Nick Barisheff, president of Bullion Management Group Inc., a Toronto-area fund company that invests in gold. Asked if the conspiracy view was accurate, he said: "It's something we will never know. It's like the assassination of Kennedy." It sounds unpatriotic for an American to endorse gold at the expense of the dollar, but Mr. Murphy argues that the alleged market fixers were un-American in their manipulation. "I think it is going to lead to a disaster," he cautioned. "What it did was take away the barometer from the little guy in America, which was wrong. In 1776, America became our country because we railed against the inequities of what the big boys were doing in England. This is what America is all about." It's not the first time Mr. Murphy has cast himself as a patriot -- he was a Boston Patriot back in the American Football League of the 1960s. He had taken hotel management at Cornell University, where he played football. After catching on with the Pats, he caught about 20 passes in his only season before he blew his knee out. He moved into futures trading on Wall Street. His moment of decision came with the collapse of Long-Term Capital Management in 1998, when powerful financial institutions bailed out the U.S. hedge fund, preventing financial chaos. Mr. Murphy expected the gold price would soar as institutions scrambled to cover the hedge fund's large short position. Instead, some major banks were selling every time gold rallied, and the collusion theory gained a convert. Mr. Murphy said that, since he founded GATA, he has been effectively silenced in mainstream U.S. TV and newspapers. "The media have not allowed our story to be told. We are taking on the richest and most powerful people in the world." But he has kept expounding his theories, shrugging off jeers from the sidelines. That wouldn't surprise Mike Holovak, his former coach with the Patriots. He once told The Wall Street Journal that Mr. Murphy "wasn't big in muscles and he wasn't particularly fast. But he always managed to get open and catch the passes. He took some awful licks but always came back." Mr. Murphy will appear at 11:40 a.m. EST on Business Morning with Jim O'Connell on Report on Business TV. The interview will be replayed on www.robtv.com |

|

|

|

Post by Healthy Merking on Dec 16, 2005 17:01:01 GMT -5

one of the other reasons that gold became valuable as a metal is because it has been proven to be one of the only metals that is safe to eat in reasonably large quantities

take that for what its worth

|

|

|

|

Post by jonnygemini on Dec 20, 2005 1:49:16 GMT -5

via: Godlike Productions

Anonymous Coward

User ID: 4358

12/20/2005 1:09 AM Re: What no Gold thread??...GOLD held $500.00

Gold bugs are the first to put down the "Evil Comex" and Curse all the "Evil" Gold shorts...

Yet they never feel bad about quoting an up gold day, right from the same source(Comex)

The Junior gold shares is where the action will take place over the next few years.

I dont buy the dollar goes to zero, end of the world SHTF crap you all like to talk about.

When this gold bull is over, and i ride some of the juniors for 2000%+ i will have the option to purchase 50x's the pysical gold you people own.

So continue to sit on your "Maybe" 100-200% gain over the next few years.

|

|

|

|

Post by UniverseSeven on Dec 20, 2005 14:12:59 GMT -5

|

|

|

|

Post by jonnygemini on Dec 20, 2005 14:34:12 GMT -5

No worries 7...I may get a few more shares if the juniors dip some more

|

|

|

|

Post by jonnygemini on Dec 21, 2005 13:33:08 GMT -5

Central bank may lift curbs on gold products Richard Fu 2005-12-22 Beijing Time THE People's Bank of China said it's considering lifting restrictions on imports and exports of gold products, something only allowed at the country's four biggest state-controlled banks and six companies. According to a draft rule posted on the Website of the People's Bank of China, applicants for a license to import and export gold are required to have registered capital of at least 30 million yuan (US$3.71 million) and no criminal record in the past two years. The central bank said it will carry out public consultations with gold producers, traders and individuals on draft guidelines until January 4. According to the draft, all companies will have to submit detailed reports on gold products that include purity, weight and the purpose of the deal. Before 2003, the central bank was the sole organization that could import gold products. The Bank of China, the Industrial & Commercial Bank of China, the China Construction Bank and the Agricultural Bank of China were given a license later. Last year, the central bank granted that right to six other companies including China National Pearl Diamond Gem & Jewelry Import & Export Corp. In May 2003, the central bank abolished the administrative approval procedure for several items like gold product manufacturing, processing, wholesale and retail businesses. www.shanghaidaily.com/art/2005/12/22/230190/Central_bank_may_lift_curbs_on_gold_products.htm |

|

|

|

Post by UniverseSeven on Jan 3, 2006 10:11:33 GMT -5

Gold up 12.60 today to 529.80

|

|

|

|

Post by Healthy Merking on Jan 3, 2006 17:46:05 GMT -5

sound like one of those things that is gonna be worth so much its going to become worthless

|

|

|

|

Post by jonnygemini on Jan 4, 2006 0:38:27 GMT -5

|

|